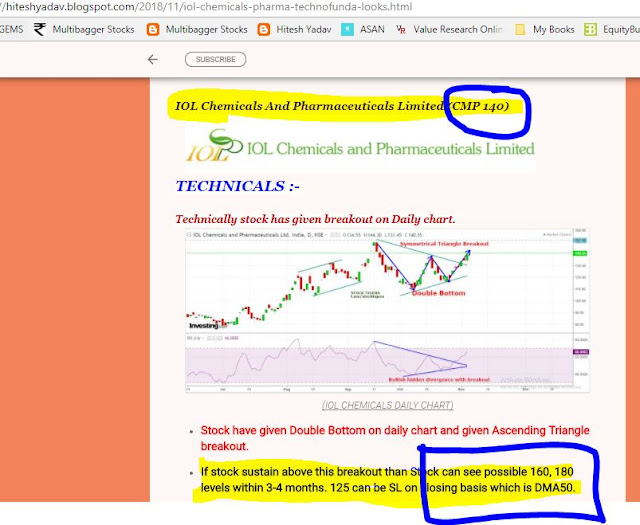

Permanent Magnet & IOLCP given 35% to 40% handsome returns in 1 month

Dear Blog readers, Recently Last Month I have uploaded research blog of IOL Chemical and Pharma on 05/11/18 and Permanent Magnet Ltd. on 18/10/18 (IOL CHEMICAL at 140) IOL chemical gained 140 to 186 in 20 days (33% up) (Permanent Magnet at 140) Permanent Magnet. Ltd. 140 to 196 in 1 month ( 40% Up) I have booked 50% quantity in Permanent Magnet and 100% quantity in IOL chemical. Blog call will open till both give multibagger return like 2x or double from research level, STOCK TIGERS ============================================