Worst Performer of the Blog :- Kesar Petro & Sunil Hitech

Dear Blog readers,

Two stocks research from my blog have not given return as expected.

Became worst performer of the blog.

Sunil Hitech Engineers

NEGATIVE :-

=====================================================================

KESAR PETROPRODUCTS ( CMP 37)

VERDICT :-

Two stocks research from my blog have not given return as expected.

Became worst performer of the blog.

Sunil Hitech Engineers

- Sunil Hitech stock was studied on 04/05/17 at 13.35 level. Click here

- After Research stock made High of 16.35, But didn't sustained at higher levels, and after heavy market correction it is trading at 7.75. which shows 40% Down from Blog research levels.

POSITIVE :-

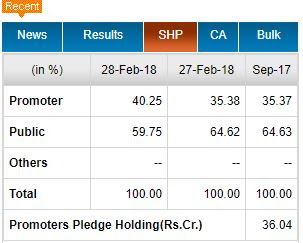

- Recent shareholding pattern shows , Promoter has increased stake from 35.38% to 40.25%.

- The company has completed the project of rehabilitation and upgrading to 2 lanes / 2 lanes with paved shoulders configuration and strengthening of Bankura - Purulia section (Km 0.00 to Km 84.00) of NH - 60A in the state of West Bengal under Phase - 1 of National Highway Inter connectivity improvement projects (NHIIP) WB - 60A-6: 2nd call) on Engineering, Procurement and Construction (EPC) basis worth Rs. 322 crore, 95 days before the scheduled completion date and has received the completion certificate / commercial operation date (COD).

- The company is entitled to maximum bonus of Rs 9.66 Crore in lieu of achieving early completion.

- Sunil Hitech’s order book stood at H5189 crore as on 31 March 2017

- On 18 August 2017 company Approved the proposal of VAG Buildtech, a subsidiary of the Company, for SME listing and raising of capital by way of an IPO.

-

Approved the proposal of Seam Industries, a subsidiary of the Company for SME listing and raising of capital by way of an IPO

- By seeing Some order details, which shows company is really doing well to sustain in this competitive market.

- Sunil Gutte the promoter of Sunil Hitech said, Budget 2018-19 is a Great Push to Infrastructure and Affordable Housing, will Strengthen Development Goals for India

- Recently RELIANCE FINANCIAL LIMITED have sold 38.87 Lakh shares of company.

- 35% shares pledged.

VERDICT :-

One can Hold with 07.00 as SL on Closing basis and wait for Q4 Result.

=====================================================================

KESAR PETROPRODUCTS ( CMP 37)

- Kesar Petro stock was studied on 08/01/18 at 54 level. Click here

- After Research stock made High of 58.00, But didn't sustained at higher levels, and after heavy market correction it is trading at 37.00 level. which shows 30% Down from Blog research levels.

- Still we are very bullish on this stock based on its fundamental story. Once again i am sending some fundamental snapshots to better understand the stock.

- A steady increase in the large pigments markets such as paint and coating will catalyse volumes.

- With the printing ink industry also performing well, it will open up newer opportunities for the Company.

- China and India control over 50% of the market and since environmental norms are limiting China’s growth and raising the cost of production, Indian players are in a vantage position.

- The key raw materials used in the manufacture of the pigments are derivatives of crude oil. Hence, prices of raw material vary with fluctuation in the international crude oil prices.

- In last six months, crude oil prices reached 72 from 55. Which ultimately increased raw material price.

- Raw material cost as a percentage of sales has decreased each year over last 3 years. Possibly this year might see some increase in raw material cost.

FINANCIALS :-

- Debt Almost Nil. Company has reduced debt.

- Company has a good return on equity (ROE) track record: 3 Years ROE 43.37%

- Company continues posting profit.

- In FY18 , company expected to give good numbers. Expected 50% jump in PAT.

POSITIVE :-

- Strong Fundamentals.

- Expected to give good numbers.

- Company has reduced debt.

- Company is virtually debt free.

NEGATIVE :-

- Recently 3-4 HUF have sod their warrants, which projected negative impact on stock price.

- Company is not paying any dividend.

- Since the Company’s operations are influenced by many external and internal factors beyond the control of the Company.

- The Company assumes no responsibility to publicly amend, modify or revise any forward looking statements, on the basis of any subsequent developments, information or events, fall in stock price.

VERDICT :-

- By seeing its fundamentals i will hold this stock for one year, and quarter to quarter review its financial results.

- If something bad happens than i will exit this stock immediately.

STOCK TIGERS

=============================================

Sir, Can we buy on dips to average out ...

ReplyDeleteAs per the latest share holding Promoter share is 39.87% and pledged shares are only 24.8%. Is it positive? can you please check and confirm.

ReplyDeleteAbove for Sunil hitech

DeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete