HCL tech or TCS Buyback ???? EARN 15% in short term

Dear members

We have received lots of queries regarding TCS & HCL Tech buyback.

Weather buy both shares or not ?

What should be procedure ?

What will be acceptance Ratio ?

So, We STOCK TIGERS have studied both companies one by one, Also checked both company's earlier Buyback Plans and its benefits to small investors.

Before entering this buyback procedure, one should know the basic concept of Buyback.

Read more: Investopedia https://www.investopedia.com/terms/b/buyback.asp#ixzz5NILXch9E

There are two types of share buybacks :-

1. They can buy the shares from the stock market.

2. They can buy the shares from the shareholders by asking them to tender their shares.

Why Company do buyback ?

After the share buyback, promoter will own a bigger portion of the company, and therefore a bigger portion of its cash flow and earnings. .

The insiders (i.e. promoters, directors or senior officer) will hold their stock and their percentage holding will increase.

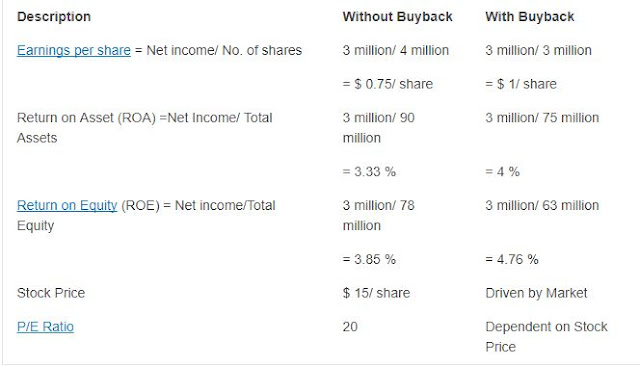

From below image , we can easily understand what impact of buyback on Financials.

Below is the details of the Both TCS & HCL Tech Buyback

HCL is buying back the shares at a premium of 12.36% to the current price of ~Rs 964 per share. Investors looking for short term opportunity can buy the shares (upto the value of Rs 2 lakhs – as on the record date still declare and till the stock goes ex benefit) in the open market and offer them in the tender offer. Which will result in 12.36% short term gain.

Investors who now buy the shares to benefit out of this opportunity will then have to sell the unaccepted shares in the open market which could result in lower

return based on the then prevailing market price..

We have received lots of queries regarding TCS & HCL Tech buyback.

Weather buy both shares or not ?

What should be procedure ?

What will be acceptance Ratio ?

So, We STOCK TIGERS have studied both companies one by one, Also checked both company's earlier Buyback Plans and its benefits to small investors.

Before entering this buyback procedure, one should know the basic concept of Buyback.

What is a 'Buyback'

A buyback, also known as a share repurchase, is when a company buys its own outstanding shares to reduce the number of shares available on the open market. Companies buy back shares for a number of reasons, such as to increase the value of remaining shares available by reducing the supply or to prevent other shareholders from taking a controlling stake.

Read more: Investopedia https://www.investopedia.com/terms/b/buyback.asp#ixzz5NILXch9E

There are two types of share buybacks :-

1. They can buy the shares from the stock market.

2. They can buy the shares from the shareholders by asking them to tender their shares.

Why Company do buyback ?

After the share buyback, promoter will own a bigger portion of the company, and therefore a bigger portion of its cash flow and earnings. .

The insiders (i.e. promoters, directors or senior officer) will hold their stock and their percentage holding will increase.

From below image , we can easily understand what impact of buyback on Financials.

- As you can see, earnings per share (EPS) increases to $1/ share from 0.75/ share. The profitability of the company has not changed. This growth in EPS is a result of the reduction in outstanding shares. Similarly, the buyback is making ROE and ROA look better.

- Theoretically, the market price rises after the share buyback. In theory, it is assumed that P/E ratio will remain same at 20 after the buyback. So, the expected market price after repurchase should be $ 20 (P/E ratio * EPS= 20 * $ 1/ Share). In practical life, the price is driven by market sentiments. So the price can be less than or more than 20. The P/E ratio would decrease if the price is less than 20 and vice versa

Below is the details of the Both TCS & HCL Tech Buyback

- From the old 2017 Buyback , it is clear that TCS had almost buyback all shares with acceptance Ratio around 100% with 16% premium from the market price.

- If we consider 2018 Buyback of Both TCS and HCL Tech, than there is little room left of only 6% in TCS at cmp while HCL Tech is still available with 12.36% premium.

- We have studied the recent tender buybacks conducted by companies. Most small shareholders do not take part in such offers with the result that the acceptance ratio becomes higher than the theoretical ratio.

- TCS is buying back the shares at a premium of 6% to the current price of ~Rs 1,978 per share. Investors looking for short term opportunity can buy the shares (upto the value of Rs 2 lakhs – as on the record date 18/08/18 and till the stock goes ex benefit) in the open market and offer them in the tender offer. Which will result in 6% short term gain.

TCS BUYBACK PROFIT AFTER BUYBACK :-

HCL TECH BUYBACK PROFIT AFTER BUYBACK :-

So, if any small investor holding less than 2 lac of Rs. quantity in both TCS & HCL Tech will take part in both buyback than cumulatively they can earn around 18.50% return from both buybacks.

"If the share price of TCS & HCL rises by the time of record date, it could result in lower % return (if the new buyer postpones the buying) or in a shareholder becoming ineligible to tender the shares if the value of his holding exceeds Rs 2 lakh as on the record date. Hence it is advisable to buy say Rs 1.75-1.80 lakhs worth shares now. vice versa if prices of both stocks lowers till record date than higher % return."

IF ANY SMALL INVESTOR WITH CAPITAL 2 LAC , CIRCULATE HIS MONEY IN 5-6 BUYBACK PLANS OF COMPANIES IN 1 YEAR,

IF WE TAKE AVERAGE 10% RETURN FROM EVERY BUYBACK THAN ABSOLUTE RETURN WILL BE 50% IN 1 YEAR.....

Tax Demand: This profit will be hit with short-term capital gains tax. And there is STT paid, so you will pay about 15% of the profit to the government as tax. A reasonably safe trade making a net 15%, post tax, in three months, is not too bad.

====================================================

Disclaimer:-

This is a personal blog and presents entirely

personal views on stock market for only education purpose. Any statement made

in this blog is merely an expression of my personal opinion. These

informations are sourced from publicly available data. By using/reading

this blog you agree to (i) not to take any investment decision or any

other important decisions based on any information, opinion, suggestion,

expressions or experience mentioned or presented in this blog (ii) Any

investment decisions taken if any would be his/hers sole responsibility. (iii)

the author of this blog is not responsible.

Before

buying any stock take advice from certified person

NOTE :

THE ABOVE IS NOT A RESEARCH

REPORT NOR A RECOMMENDATION BUT INFORMATION AS AVAILABLE ON PUBLIC

DOMAIN.

Registration

status with SEBI: I am not registered with SEBI under the (Research Analyst)

regulations 2014 and as per clarifications provided by SEBI: “Any person who

makes recommendation or offers an opinion concerning securities or public

offers only through public media is not required to obtain registration as

research analyst under RA Regulations”

.

.

Hitesh Sir, Thanks for the insight of these Buybacks. Is it true that Acceptance ratio would be 100% if my investment is 2 Lakhs? I see the details here but any source that i can refer to about assurance of 100% buy back would be appreciated. thanks!

ReplyDeleteHCL Tech and TCS both stocks reached their buyback price..

ReplyDeleteThis Information is really good and informative. Thanks for it.

ReplyDeleteCheck below links and get useful information.

CAMSL IPO

Peculiar article, exactly what I wanted to find.

ReplyDeleteIt's very effortless to find out any matter on net as compared to textbooks, as I found this post at this web site.

ReplyDelete