Comparative Analysis of HEG & Graphite India.......

Dear Blog Readers,

Recently two stocks are in focus of every investors in market. So i did some comparative analysis and detail research of current scenario of Graphite industries.

Recently two stocks are in focus of every investors in market. So i did some comparative analysis and detail research of current scenario of Graphite industries.

HEG ( cmp 1904)

|

GRAPHITE INDIA ( cmp 589)

|

|||||||

Business

|

The main business of HEG is graphite which accounts for 80% of the

revenue.

The principal raw materials used in the manufacture of electrodes are

Needle coke and pitch.

Apart from Graphite

Electrodes, other main products are –

1) Activated Carbon Fabric (ACF)

2) Carbon Blocks

3) Graphite Specialities

|

Graphite India Limited (GIL) is the pioneer in India for manufacture

of Graphite Electrodes as

well as

Carbon and

graphite Speciality products.

Apart

from Graphite Electrodes,

other main products are –

1) Speciality Carbon and Graphite 2) Impervious Graphite Equipment

3) Calcined Petroleum Coke

& Carbon Electrode Paste

4)

Glass Reinforced Plastic Pipes

5)

High Speed Steel & Alloy Tool Steels

|

||||||

Promoter

|

Bhilwara Group

|

Having started in 1967 in collaboration with

erstwhile Great Lakes Carbon Corporation (GLCC) of USA

|

||||||

Capacity

|

Capacity : 80,000 MT per annum

|

Capacity : 18000 tons per annum.

Thus the total group capacity is nearly 98,000 tons per annum

|

||||||

Plant

|

Madhya Pradesh

|

GIL’s manufacturing facilities are spread

across 6 plants in India with an aggregate electrode manufacturing capacity

of 80000 tons per annum.

Plants at

Satpur, Durgapur, Bangalore, Nasik

|

||||||

Market Cap

|

7607.02

|

11,487 Cr

|

||||||

BV

|

238.38

|

95.08

|

||||||

FV

|

10

|

2

|

||||||

52 WK High/Low

|

2091.75/144.10

|

633.95/70.65

|

||||||

Annual Result

|

FY17

|

FY16

|

FY15

|

FY14

|

FY17

|

FY16

|

FY15

|

FY14

|

-50.1

Cr

|

-15.15

Cr

|

39.0

Cr

|

86.62

Cr

|

112.28 Cr

|

82.38 Cr

|

82.19 Cr

|

170.92 Cr

|

|

ROE

|

-5.75%

|

6.06%

|

||||||

Debt/Equity

|

0.78

|

0.07

|

||||||

Assets

|

1828.66 Cr

|

2418 Cr

|

||||||

Promoter Holding

|

61.04 %

|

65.22

%

|

||||||

Key Takeaways from Comparison :-

- Graphite India is winning the battle if comparing with HEG.

- Graphite is Profit making company while HEG making loss from last two years. Might see some turnaround result in FY18 in HEG.

- Both company reducing debt constantly. But if we can see Graphite India has Lower debt compared to HEG.

- By comparing Graphite India has more Assets.

- Also Graphite India Market cap is more.

- Grapite India has 4 plants at various locations while HEG has 1 plant at Madhya Pradesh. So obviously Graphite Indiahas more Production capacity.

Why both stocks run up so fast in last 3 months ?

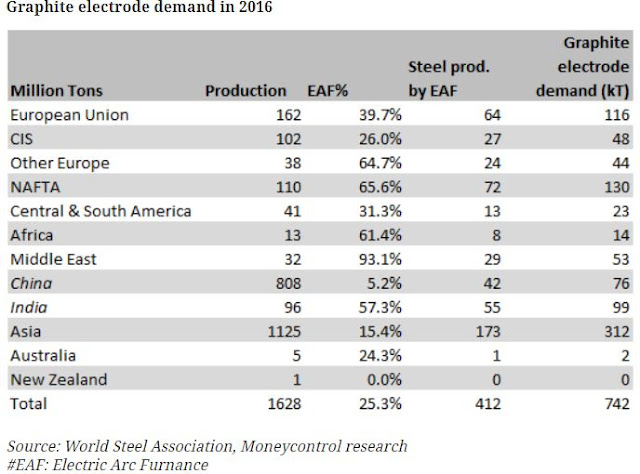

- Graphite electrode manufacturers are the key beneficiary of the improvement in its end market - global steel demand.

- Lower supply and higher demand to entry is also positive news.

- One of the main reason behind recent rally in graphite electrode has been on the back of news flow that there has been a clamp-down in the graphite electrode manufacturing capacity in China on account of stringent pollution norms.

- China is on its way to cut graphite electrode capacity by around 50 percent.

- About 8-9 percent incremental increase in demand for graphite electrode is possible due to developments in China.

- With the tightness on the supply side, given the change in the industry structure and demand remaining healthy, the demand supply balance has shifted in the favour of the suppliers. This has resulted in a significant increase in graphite electrode prices to nearly USD 4,000/t from USD 2,000/t in the spot market.

Is there any steam left in stocks ?

- I think steam is left in both the stocks.

- HEG might also look at fresh capex, as capacity utilisations reach 80%-85% in FY19.

- HEG could also look at fresh capex in FY19 at the existing plant location to increase the capacity to nearly 100,000 tpa (FY17: 80,000 tpa).

- HEG might give turnaround result in FY18, Also there might 2-3 fold jump in FY18 result of Graphite India.

- Graphite India had posted a more-than-6 times (600%) net profit at Rs 16 crore in September quarter (Q2FY17) against Rs 90 crore in Q2FY18.

- HEG had posted a more-than-8 times (800%) net profit at Rs 13 crore Loss in September quarter (Q2FY17) against Rs 113 crore Profit in Q2FY18.

My View : -

- By comparing both stocks, both are buy on dips.

- HEG can give turnaround result and Capex there which will benefit sure.

- Graphite is profit making company, fundamentally strong and also can give good result.

- One can see 20-30% upside from here in both shares in short term.

- My choice is Graphite India fro target of 900, 1000 in long term.

Happy Investing

=========================================================================

Disclaimer:-

This is a personal blog and presents entirely personal views on stock market for only education purpose. Any statement made in this blog is merely an expression of my personal opinion. These informations are sourced from publicly available data. By using/reading this blog you agree to (i) not to take any investment decision or any other important decisions based on any information, opinion, suggestion, expressions or experience mentioned or presented in this blog (ii) Any investment decisions taken if any would be his/hers sole responsibility. (iii) the author of this blog is not responsible.

Before buying any stock take advice from certified person

NOTE : THE ABOVE IS NOT A RESEARCH REPORT NOR A RECOMMENDATION BUT INFORMATION AS AVAILABLE ON PUBLIC DOMAIN.

Registration status with SEBI: I am not registered with SEBI under the (Research Analyst) regulations 2014 and as per clarifications provided by SEBI: “Any person who makes recommendation or offers an opinion concerning securities or public offers only through public media is not required to obtain registration as research analyst under RA Regulations”

Thanks for updates

ReplyDeleteRequest ur view on RAIN IND

ADITYA BIRLA CAP and SINTEX PLAST

long term

My mail ID is hemantbaroda@gmail.com

Iplan to buy for 4 years to 5 years.

Thanks

Any fundamentaly good stocks for Long term @ 1-2 years. any 5to8 stocks . Thanks

ReplyDeleteHEG reached to 3150...all time high

ReplyDeleteAacunVde_wo Shelly Carfindergirl https://wakelet.com/wake/Hm7fg4knBAPMIXQXMuLUi

ReplyDeleteusscounhardchest

simpdiat-ro Leslie Holloway UltraISO

ReplyDeleteDr.Web Security Space

Pinnacle Studio

afininhar